Personal Income Tax (PIT) finalization is the annual tax reconciliation process that foreign employees in Vietnam must complete within 90 days after year-end or 45 days before departure, determining final tax liability based on residency status under the 183-day rule (Law 109/2025/QH15, Article 47). Late filing triggers 0.03% daily interest on overdue tax plus administrative penalties for incorrect declarations under current tax administration regulations. The primary compliance risks are residency determination errors under the 183-day rule, finalization procedure failures with split-year 2026 calculations, and Double Taxation Agreement (DTA) claim denials.

Individuals holding a permanent residence card or a qualifying long-term lease in Vietnam are treated as resident individuals for PIT purposes, even when actual days of presence are limited, subject to conditions on proving tax residency in another jurisdiction under current guidance. Foreign Legal Representatives face temporary exit suspension risks where their company’s tax debts remain unpaid beyond statutory enforcement periods, and Chief Representatives must finalize PIT on offshore salaries when they meet the 183-day residency test. Departing expats must finalize 45 days before exit to obtain tax clearance for work permit cancellation.

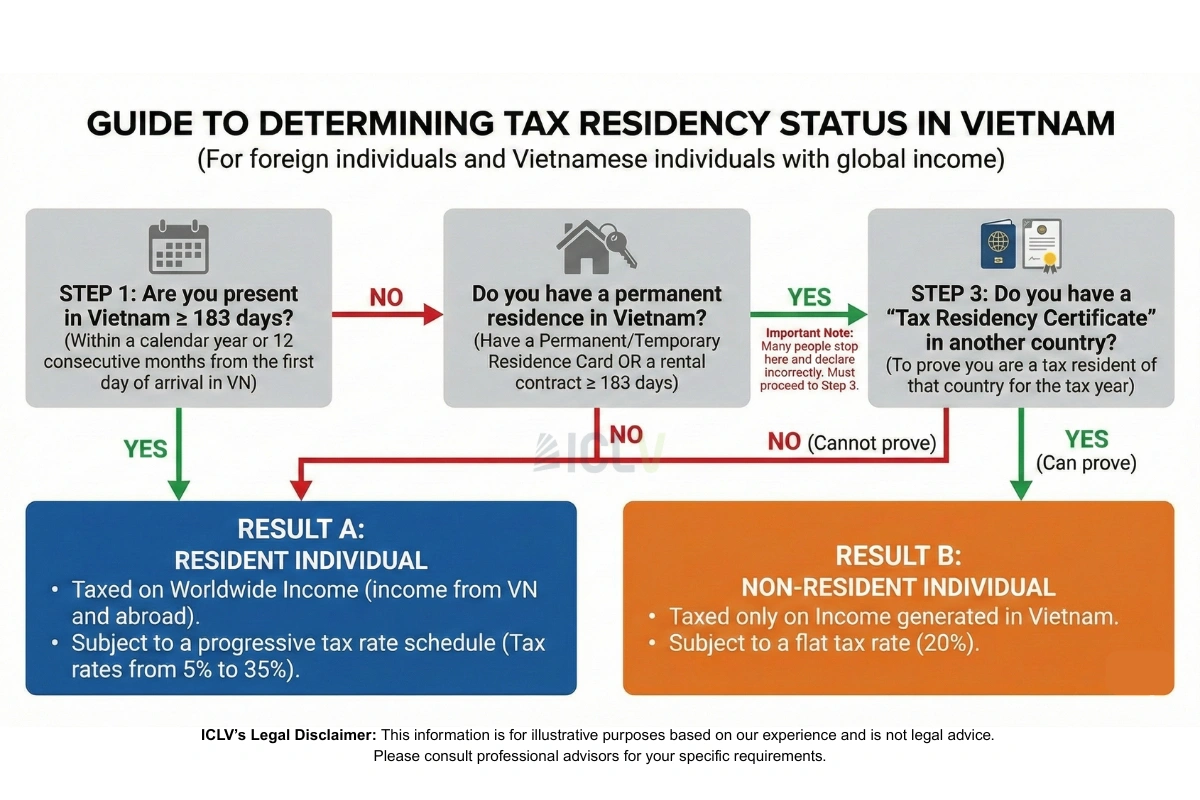

Tax Residency Determination: The 183-Day Rule

You become a Vietnam tax resident if you meet ANY of these criteria:

- Physical presence in Vietnam for 183 days or more within a calendar year, OR

- Physical presence for 183 days or more within any consecutive 12-month period starting from your first arrival date, OR

- You register a permanent residence in Vietnam (rare for expats), OR

- You lease a residence in Vietnam with a contract term of 183 days or more—applies even if you don’t occupy the residence continuously

Residents pay progressive rates (5%-35%) on worldwide income after deductions. Non-residents pay a flat 20% on Vietnam-sourced employment income only—no deductions allowed.

The General Department of Taxation counts any part of a 24-hour period as a full presence day. Arrival at 11:50 PM counts as Day 1. The GDT reviews entry/exit stamps and audits frequently recalculate presence days including previously excluded business travel (Law 109/2025/QH15, Article 2, guided by Circular 111/2013/TT-BTC Article 1).

Tax year defaults to calendar year (January 1-December 31), but expats arriving mid-year can elect a 12-month period from arrival by notifying the Tax Authority within 30 days. Without this election, late-year arrivals may face dual-status complexity.

Permanent residence cardholders are tax residents from day one of income receipt. This requires full progressive tax bracket application and annual finalization regardless of actual days in Vietnam. Audits frequently recalculate tax liability retroactively when expats assume physical presence rules apply.

| ⚠️ COMPLIANCE ALERT: Expats with Vietnam permanent residence cards are TAX RESIDENTS from day one—even where actual presence days are limited under Law 109/2025/QH15 |

Dual-status scenarios occur when an expat transitions from non-resident to resident mid-year. Income before residency is taxed at 20%, post-residency income follows progressive brackets. Retroactive residency determination during audits leads to back-tax assessments, late-payment interest of 0.03% per day on any tax shortfall, and administrative penalties for under-declaration or late payment under Law on Tax Administration 2019 as amended.

Tax residency status intersects with employment contract structure and work permit validity—for the full employer compliance framework, see Vietnam employment law and HR compliance for FDI companies.

PIT Finalization Process: Deadlines & 2026 Law Changes

Expats must file Form 02/QTT-TNCN by March 31 of the following year for calendar-year filers, or within 45 days before departure for mid-year exits. The 45-day pre-departure deadline is strictly enforced—processing takes 15-20 business days minimum, and tax clearance certificates are required for work permit cancellation (Law 109/2025/QH15, Article 47).

Finalization splits between employer-managed and self-filed. Employer-managed applies when the expat receives income from a single Vietnamese employer who withholds PIT monthly. Self-filing is mandatory for multiple income sources, non-withholding income, or when claiming deductions the employer didn’t process.

Who Must Self-File vs Employer-Managed Finalization

Employer Authorization:

- ONE employer in Vietnam, all income is salary from that employer

- Monthly withholding covered 100% of Vietnam tax liability

- Employer files Form 02/QTT-TNCN within 90 days after year-end

Self-Finalization – Mandatory when:

- Multiple employers in Vietnam

- Income from outside Vietnam (foreign salary, dividends, rental income)

- Non-withholding income (freelance fees, director fees)

- Departing mid-year

- Annual income exceeds VND 100 million with non-employment income

Contract type determines whether employer-managed or self-finalization applies—review Vietnam labor contract types and written contract requirements for PIT withholding implications.

Critical trap: Expats with worldwide income often assume employer withholding equals finalization complete. If you earned salary from your home country employer while working in Vietnam, you MUST self-finalize and declare that foreign income. Employer authorization does not cover it. C-level executives and Legal Representatives face higher scrutiny on worldwide income.

Special Roles Attention Beyond standard employees, Foreign Legal Representatives and Chief Representatives of Representative Offices must strictly adhere to finalization rules. These roles often face higher scrutiny regarding “Global Income” and are subject to immediate exit suspension if personal tax liabilities are outstanding.

| Scenario | Deadline | Authority |

|---|---|---|

| Employer finalizes (authorized) | 90 days after calendar year-end | Circular 111/2013/TT-BTC (amended), Law 109/2025/QH15 |

| Individual self-finalizes | 90 days after calendar year-end | Law on Tax Administration 2019 Article 44 |

| Foreigner departing Vietnam | Before exit / within 45 days of contract termination | Circular 111/2013/TT-BTC (amended), Law 109/2025/QH15 |

| First-year resident (arrival mid-year) | 90 days after first 12-month period ends | Circular 111/2013/TT-BTC (amended), Law 109/2025/QH15 |

2026 Progressive Tax Brackets & Required Documents

The new PIT Law consolidates seven tax brackets into five tiers effective January 1, 2026. Personal deductions increase from VND 11 million to VND 15.5 million monthly, dependent deductions from VND 4.4 million to VND 6.2 million per qualified dependent, effective January 1, 2026.

The new bracket change directly impacts gross-to-net calculations for every employee—see employer payroll costs and gross-to-net calculation guide for worked examples with 2026 deductions.

Form 02/QTT-TNCN requires:

- Annual PIT withholding statement from employer (Form 11-TNCN)

- Proof of dependent registrations if claiming dependent deductions

- Insurance premium receipts if claiming voluntary insurance deductions

- For DTA claims: Tax residency certificate from home country + DTA notification form filed at assignment start

- For departing expats: Exit flight booking or contract termination letter + work permit documents

Tax clearance certificate (Form 08-MST) is required for work permit cancellation. PIT refunds are processed by the tax authority after review and are typically paid via bank transfer—processing time can vary by locality and case, so taxpayers should allow for administrative review rather than relying on a fixed timeframe.

Employees near minimum wage floors benefit most from the increased personal deductions—see Vietnam’s 2026 minimum wage rates and downstream payroll impact for bracket interaction effects.

Common Expat Scenarios: Practical Application

Scenario 1: Mid-Year Arrival

You arrived July 1, Year 1, worked until December 31 (184 days). You’re a resident for Year 1 (183+ days under Circular 111/2013/TT-BTC Article 1). File by March 31, Year 2. Declare income from July 1-December 31, Year 1. Apply progressive rates and claim family deductions for 6 months present.

Scenario 2: Mid-Year Departure

You terminate May 31, Year 2 after arriving January 1, Year 1. Year 2 presence: 151 days (non-resident unless lease triggers residency). File within 45 days (by July 15, Year 2) under Law 109/2025/QH15, Article 47. If non-resident, pay flat 20%. If resident, apply progressive rates.

Steps: (1) Notify employer immediately, (2) Gather documents (labor contract, termination decision, tax withholding receipts, passport, work permit documents), (3) File Form 02/QTT-TNCN, (4) Obtain tax clearance (Form 08-MST), (5) Employer cancels work permit.

Tax clearance is required before work permit cancellation—confirm the full cancellation sequence in Vietnam work permit requirements and FDI compliance procedures.

Scenario 3: Multiple Employers

You worked for Company A (January-June) and Company B (July-December), both withheld PIT. Self-finalization mandatory under Law on Tax Administration 2019 Article 44. Aggregate income, apply progressive rates to combined taxable income. Documents: tax withholding certificates from both companies, labor contracts, passport.

Special Compliance for Legal Representatives & Chief Representatives

For C-level executives, Legal Representatives, and Chief Representatives, PIT compliance extends beyond simple salary withholding. Due to the complexity of compensation packages and legal liabilities, these roles face higher scrutiny from the General Department of Taxation.

The Worldwide Income Obligation

A common misconception among foreign executives is that tax only applies to salary received in Vietnam. Wrong. If you’re a tax resident, you owe PIT on worldwide income regardless of where the salary is paid or the currency used. “Split-salary” arrangements where part is paid in Vietnam and part offshore are strictly monitored—failure to declare offshore income is considered tax evasion, leading to severe penalties and back-tax assessments.

In practice: The Tax Authority cross-checks work permit validity periods against declared income. If your work permit shows 12 months of Vietnam employment but you only declared 6 months of Vietnam salary, audits will investigate offshore payments. Tax residents must declare and finalize PIT on the full compensation package, including bonuses, stock options, and allowances paid by the parent company abroad (Law 109/2025/QH15, Article 2).

Tax-Exempt Benefits Available to Executives

High-income earners can reduce their effective tax burden by leveraging non-taxable benefits allowed under Circular 111/2013/TT-BTC. Unlike cash allowances which are fully taxable, the following are exempt from PIT when paid directly to providers with valid invoices:

- School fees: Tuition for children from preschool to high school studying in Vietnam—paid directly to the educational institution

- Housing: Rental paid by employer to landlord is capped at 15% of total taxable income (excluding the housing benefit itself). For executives with high rental costs, this cap creates significant tax savings

- Home leave: One round-trip air ticket per year to home country per employee

- Relocation costs: Moving fees when starting or ending the Vietnam assignment—furniture shipping, temporary accommodation, visa costs

Strategic application: If your monthly gross salary is VND 100 million and your employer pays VND 40 million rent directly to your landlord, only VND 15 million (15% of VND 100M) counts as taxable income. You avoid tax on VND 25 million monthly—a saving of VND 8.75 million per month at the 35% bracket (VND 105 million annually). The employer pays the full VND 40 million rent, but your taxable benefit is capped.

Legal Representative Exit Suspension Risk

If a company’s tax debts remain overdue beyond the statutory period, the tax authority may request temporary exit suspension for responsible individuals and will notify both immigration authorities and the affected individuals in accordance with Law on Tax Administration 2019—travelers can still experience last-minute issues at the airport if the suspension is not lifted in time.

What you need to do: Before international travel, verify with your accountant that all corporate tax is current. If cash flow issues exist, arrange a payment plan with the Tax Authority before the debt reaches enforcement stage—once the exit block triggers, you have no negotiating leverage.

Chief Representative Offshore Salary Obligations

Chief Representatives of Representative Offices who meet the 183-day residency test must declare and finalize PIT on offshore salary paid by the parent company abroad. The common belief that RO salaries are tax-exempt is incorrect.

The risk: Tax Authority cross-references work permits with PIT filings. Missing filings trigger automatic audits with 20% penalties plus 0.03% daily interest under Law on Tax Administration 2019—often accumulating to 30-40% of tax liability. Where a DTA applies, relief is contingent on satisfying procedural requirements and providing supporting documents—late or missing submissions can result in denial of relief in specific cases, but the consequences depend on the relevant treaty framework and implementing guidance.

Compliance Risks & Common Failures

Residency misclassification creates the largest tax exposure when employers incorrectly exclude business travel days or miss permanent residence status. GDT audits recalculate presence days by reviewing immigration stamps and work permit validity—this results in back-taxes plus 20% penalty plus 0.03% daily interest from the original due date under Law on Tax Administration 2019.

Late finalization triggers 0.03% daily interest on any additional tax owed. For departing expats, late finalization blocks work permit cancellation—you can’t leave without tax clearance but can’t obtain clearance without finalizing. Overstaying work permit validity triggers immigration penalties.

For DTA relief, tax authorities require timely notification and supporting documentation under the applicable treaty and guidance. Late or incomplete submissions can make relief more complex or lead to denial in specific cases—whether retroactive relief is available depends on the relevant DTA and its implementing procedures rather than a universal rule.

Departure without finalization creates employer liability. The employer remains jointly liable for unpaid PIT if the employee is unreachable after departure—employers must withhold final salary until tax clearance is obtained.

Employer liability for unpaid PIT after departure makes proper termination procedures critical—see employee termination legal grounds and severance calculation procedures for compliant exit processes.

Departing expats must coordinate PIT finalization with social insurance lump-sum refund timing to avoid processing conflicts—see Vietnam social insurance 2026 rates, expat refunds, and VSS procedures.

Conclusion

Tax residency status under the 183-day rule determines whether expats face progressive resident tax brackets or flat non-resident rates on Vietnam-sourced employment income. Any future PIT law changes will need to be monitored so that payroll systems can be updated promptly once official parameters are announced. DTA relief for expat employees generally requires timely filing and supporting residency certificates under the applicable treaty and implementing guidance—late or incomplete dossiers can lead to denial of relief in practice, but specific timelines and retroactivity depend on the governing DTA procedures. For departing expats, start finalization 45 days before exit to avoid work permit cancellation delays.

PIT finalization is one element of year-end compliance—employers must also reconcile trade union fee obligations calculated on the social insurance salary base before closing annual payroll accounts.

This guide provides general information on Vietnam PIT finalization procedures and does not constitute legal or tax advice. Consult qualified tax advisers or contact the tax authority for case-specific guidance.

Indochina Link Vietnam provides end-to-end PIT finalization services for FDI companies: residency determination, DTA optimization, eTax registration, and departure compliance. Contact our tax team for a payroll compliance review before the 2026 law transition.

File Form 02/QTT-TNCN within 45 days of contract termination. Apply the 183-day test to determine residency for the partial year. Gather documents: labor contract, termination decision, tax withholding receipts, passport, work permit documents. Authorize your employer to file if you have only Vietnam employment income from that single employer, otherwise self-finalize. Request tax clearance letter (Form 08-MST)—required for work permit cancellation.

No. Employer authorization covers only Vietnam employment income from that single employer. If you received foreign salary, dividends, or rental income, you must self-finalize. File Form 02/QTT-TNCN individually, declare all income sources, and claim foreign tax credit under the relevant DTA. Required: foreign tax payment certificate (certified and translated), payslips from foreign employer, DTA article copy.

Submit finalization dossier (Form 02/QTT-TNCN) with documents showing overpayment. Local Tax Department reviews and issues refund decision. Processing takes 3-6 months. Refunds paid via bank transfer to registered account.